I parsed the data at CrunchBase.com for startups in San Francisco. Crunchbase has a pretty easy to use API.

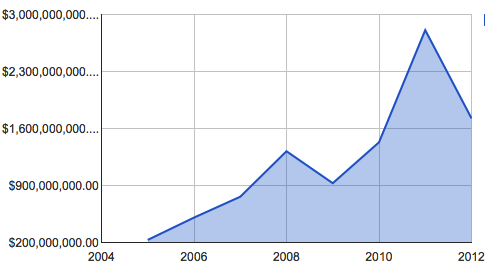

I wanted to see how much startup funding was coming into San Francisco. Was it close to the $20 million per day during the peak in 1999?

It turns out that the peak of this current technology boom happened last year and at current rates of investment we’re almost back to where we were 2 years ago.

Year Per Day 2005 $231,850,000.00 $635,205.48 2006 $505,934,000.00 $1,386,120.55 2007 $762,064,970.00 $2,087,849.23 2008 $1,320,579,950.00 $3,618,027.26 2009 $928,213,997.00 $2,543,052.05 2010 $1,430,424,359.00 $3,918,970.85 2011 $2,807,900,000.00 $7,692,876.71 2012 $1,725,000,000.00 $6,738,281.25 (estimated year end projection)

Is it the end of the technology bubble or just a correction?

Leave a Reply